Meridian’s Drilling Extends High-Grade Gold-Copper Ore Zone at Cabaçal Via Gold Veins Grading up to 276g/t Au

– CD-654: 9m @ 14.8g/t AuEq (11.0% CuEq ) from 29.3m; including:

9m @ 71.4g/t AuEq (53.1% CuEq) from 30.1m;

– CD-667: 6m @ 1.4g/t AuEq (1.0% CuEq) from 13.4m including:

6m @ 2.2g/t AuEq (1.6% CuEq) from 18.3m

Meridian Mining UK S (TSX: MNO), (Frankfurt/Tradegate: 2MM) (OTCQX: MRRDF) (“Meridian” or the “Company”) – https://www.commodity-tv.com/ondemand/companies/profil/meridian-mining-uk-societas/ – is pleased to announce that it has drilled one of the highest grading gold veins to date at its advanced Cu-Au-Ag Cabaçal VMS project (“Cabaçal”). Targeting potential extensions to Cabaçal’s Pre-Feasibility Study’s (“PFS”) high-grade ore reserves[1], CD-654 drilled one of the best grading gold veins to date at Cabaçal, returning 276 g/t Au over 0.46m. This was within a broader shallow gold-copper-zone that returned 9.9m @ 14.8g/t AuEq from 29.3m. The Company is also reporting multiple stacked layers of Au-Cu mineralization within Cabaçal’s PFS pit shell. These results continue to improve the strong upside that remains within Cabaçal and will be included into a future resource and reserve calculation for Cabaçal’s Definitive Feasibility Study (“DFS”). Drilling continues and more results are pending.

Mr. Gilbert Clark, CEO, comments: “CD-654’s high-grade gold-copper intercept has confirmed a potential extension to one of Cabaçal’s shallow higher grade ore zones. The drilling of extremely high-grade gold veins grading up to 276g/t Au, is a tremendous result in itself, and for the future remodelling of this area. Having these high-grade results at shallow depths, and potentially more yet to be drilled, can only positively contribute to the soon to be launched Cabaçal DFS. Over the last few months, we have extended mineralization both at Cabaçal and Santa Helena while continuing to advance our regional exploration programs. These efforts reaffirm the Cabaçal belt’s status, as the premier gold-copper VMS belt in South America.”

Cabaçal Update

The ongoing drill program at Cabaçal is aimed to test and potentially unlock further upside identified by Meridian’s resource development team. Additionally, it increases the local coverage of targeted angled drilling in areas dominated by historical vertical drilling. This drilling better intercepts any additional higher-grading gold vein sets, like CD-654’s, hosted within the shallow-dipping Au-Cu VMS mineralization. Today’s successful results (“Table 1”) are part of this ongoing drill program that is looking at local extensions to higher-grade zones of known gold and copper ore.

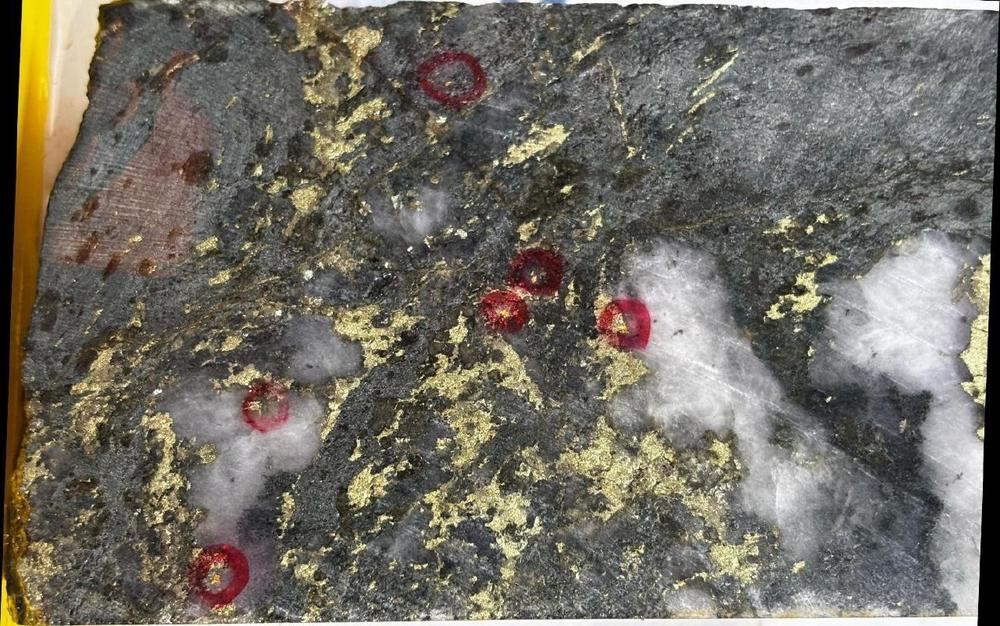

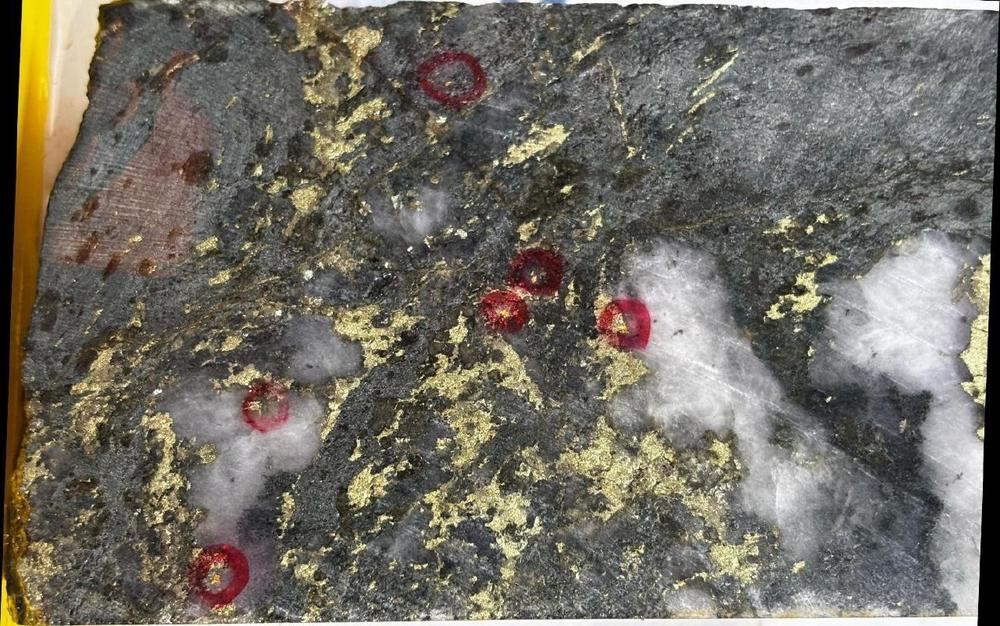

CD-654 was drilled in a shallow sector of the Eastern Copper Zone (“ECZ”) with historical workings (“Figure 1”) and successfully drilled a projected down-dip extension of high-grade Au-Cu ore. Returning 9.9m @ 14.8g/t AuEq (11.0% CuEq) (14.4g/t Au, 0.6% Cu & 2.7g/t Ag) from 29.3m, including 1.9m @ 71.4g/t AuEq (53.1% CuEq) (72.5g/t Au, 0.9% Cu & 4.3g/t Ag) from 30.1m. This included a higher-grade Au vein set grading 276 g/t Au over 0.46m (Photo 1) with visible gold. Locally this extension had lacked drilling, lowering the modelled grade despite being adjacent to a zone where higher-grade gold and copper was historically mined. Consequently, CD-654 has corrected this, and additional drilling is being reviewed to test for dip / plunge projections of this high-grade trend.

Shallow drilling (“Figure 2”) also targeted mineralization in the up-plunge flank of the void model of the Central Copper Zone (“CCZ”). Hole CD-667 was collared in an area where historical drilling was only partially assayed. The hole returned a broad zone of mineralization: 38.6m @ 1.4g/t AuEq (1.0% CuEq) from a depth of just 13.4m, including a higher-grade zone 15.6m @ 2.2g/t AuEq (1.6% CuEq) from 18.3m, emphasising the presence of shallow mineralization above the mined voids, transitioning into an unsampled area. Additional mineralization was encountered on the lower side of the void model, returning 7.8m @ 1.2g/t AuEq (0.9% CuEq) from 56.7m.

A series of angled infill holes were drilled into the down-plunge sector of the CCZ. These holes will assist in modelling grade distribution and improving density modelling in some of the more copper-rich areas of the deposit.

Results confirm the robust grades in the mining area, including between levels for various holes that intersected voids (CD656: 114.8 – 118.7m; CD-657: 63.0 – 64.8m, 86.0 – 87.4m; CD-658: 94.9 – 98.2m; CD-665: 56.0 – 58.5m, 80.1 – 81.1m; CD-666: 40.0 – 43.7m, 59.9 – 63.9m).

Lower grade holes CD-641 , CD-642 were drilled into the far up-dip flanking sector of the deposit where the mineralization profile is truncated by erosion and weathering, and hole CD-650 to cover an unsampled sector of an historical hole, JUSPD053. A few holes were drilled into more peripheral areas: ECZ extension (CD645, CD646); Cabaçal South (CD-664).

Metallurgical Pilot Plant Testwork

The Company is preparing a large selection of diamond core that will be shipped to a Canadian laboratory for the DFS stage of metallurgical studies. This selection is representative of the ore that will be mined in the early phases of open pit mining at Cabaçal. It will also provide the Company with a representative sample of the copper sulphide concentrate (with high gold and silver contents) for marketing purposes with smelter and trading groups.

About Meridian

Meridian Mining is focused on:

The Pre-feasibility Study technical report (the “PFS Technical Report”) dated March 31, 2025, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Pre-feasibility Study” outlines a base case after-tax NPV5 of USD 984 million and 61.2% IRR from a pre-production capital cost of USD 248 million, leading to capital repayment in 17 months (assuming metals price scenario of USD 2,119 per ounces of gold, USD 4.16 per pound of copper, and USD 26.89 per ounce of silver). Cabaçal has a low All-in-Sustaining-Cost of USD 742 per ounce gold equivalent & production profile of 141,000 ounce gold equivalent life of mine, driven by high metallurgical recovery, a low life-of-mine strip ratio of 2.3:1, and the low operating cost environment of Brazil.

The Cabaçal Mineral Reserve estimate consists of Proven and Probable reserves of 41.7 million tonnes at 0.63g/t gold, 0.44% copper and 1.64g/t silver (at a 0.25 g/t gold equivalent cut-off grade).

Readers are encouraged to read the PFS Technical Report in its entirety. The PFS Technical Report may be found under the Company’s profile on SEDAR+ at www.sedarplus.ca and on the Company’s website at www.meridianmining.co

The PFS Technical Report was prepared for the Company by Tommaso Roberto Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering Canada ULC; Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering Canada ULC; John Anthony McCartney, C.Geol., Ausenco Chile Ltda.; Porfirio Cabaleiro Rodriguez (Engineer Geologist FAIG), of GE21 Consultoria Mineral; Leonardo Soares (PGeo, MAIG), Senior Geological Consultant of GE21 Consultoria Mineral; Norman Lotter (Mineral Processing Engineer; P.Eng.), of Flowsheets Metallurgical Consulting Inc.; and, Juliano Felix de Lima (Engineer Geologist MAIG), of GE21 Consultoria Mineral.

Technical Notes

Samples have been analysed at ALS laboratory in Lima, Peru. Samples are dried, crushed with 70% passing 85% passing 200µm. Routine gold analyses have been conducted by Au‐AA24 (fire assay of a 50g charge with AAS finish). High‐grade samples (>10g/t Au) are repeated with a gravimetric finish (Au‐GRA22), and base metal analysis by methods ME-ICP61 and OG62 (four acid digest with ICP-AES finish). Visible gold intervals are sampled by metallic screen fire assay method Au‐SCR21. Samples are held in the Company’s secure facilities until dispatched and delivered by staff and commercial couriers to the laboratory. Pulps and coarse rejects are retained and returned to the Company for storage. The Company submits a range of quality control samples, including blanks and gold and polymetallic standards supplied by Rocklabs, ITAK and OREAS, supplementing laboratory quality control procedures. Approximately 5% of archived samples are sent for umpire laboratory analysis, including any lots exhibiting QAQC outliers after discussion with the laboratory. In BP Minerals sampling, gold was analysed historically by fire assay and base metals by three acid digest and ICP finish at the Nomos laboratory in Rio de Janeiro. Silver was analysed by aqua regia digest with an atomic absorption finish. True width is considered to be 80-90% of intersection width, except in the case of those listed in Table 1 as “Subparallel , for which true width is 40-60% of intersection width. Assay figures and intervals are rounded to 1 decimal place. Gold equivalents for new results reported from Cabaçal are calculated as: AuEq(g/t) = (Au(g/t) * %Recovery) + (1.346*(Cu% * %Recovery)) + (0.013*(Ag(g/t) * %Recovery)), and Copper equivalents are calculated as: CuEq(%) = (Cu(%) * %Recovery) + ((0.743* (Aug/t * %Recovery)) + ((0.0094*(Ag(g/t) * %Recovery)) where:

Recoveries based on 2022 and 2023 metallurgical testwork on core submitted to SGS Lakefield

Qualified Person

Mr. Erich Marques, B.Sc., FAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, verified, and approved the technical information in this news release.

Cautionary Statement on Forward-Looking Information

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian’s most recent Annual Information Form filed on www.sedarplus.ca. While these factors and assumptions are considered reasonable by Meridian, in light of management’s experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()