U.S. GoldMining Inc. Announces Plans to Commence an Initial Economic Assessment At Whistler Gold-Copper Project, Alaska

Highlights:

Tim Smith, Chief Executive Officer of U.S. GoldMining, commented: "The Company is delighted to commence the PEA process for the Project. This comes just two years after we completed our initial public offering. We began the re-discovery of the Project, including our initial exploration drill program, in 2023. This is another major step in moving the development of Whistler forward and is made possible by the excellent drill results returned from the 2023 and 2024 drill programs, including multiple intercepts of high-grade mineralization within the existing deposits at Whistler and Raintree. We have received strong interest from multiple potential mine engineering partners, and we look forward to making a further announcement about the awarding of the PEA contract in the near term. The Company is fully financed and has full Board support to complete the planned PEA. We also look forward to further announcements as to advancement of the proposed West Susitna Access Road which will connect Whistler with existing highway, port facilities and grid power infrastructure near Anchorage. The decision to proceed with a PEA on the Project underlines our belief that Whistler could present a robust future mining opportunity thereby offering significant organic growth for the Company, economic development for South Central Alaska and an important contribution to mineral resources security within the United States."

For further information regarding the Project and the mineral resource estimates referenced herein, refer to the technical report summary titled “S-K 1300 Technical Report Summary Initial Assessment for the Whistler Project, South Central Alaska” with an effective date of September 12, 2024, and the technical report titled “NI 43-101 2024 Updated Mineral Resource Estimate for the Whistler Project, South Central Alaska” with an effective date of September 12, 2024, available under the Company’s respective profiles at www.sec.gov and www.sedarplus.ca.

Tim Smith, P.Geo., Chief Executive Officer of the Company, has supervised the preparation of this news release and has reviewed and approved the scientific and technical information contained herein. Mr. Smith is a "qualified person" as defined under NI 43-101.

About U.S. GoldMining Inc.

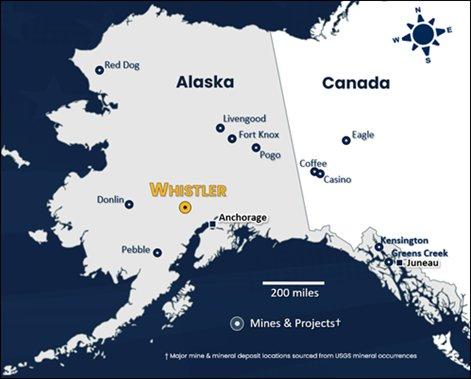

U.S. GoldMining Inc. is an exploration and development company focused on advancing the 100% owned Whistler Gold-Copper Project, located 105 miles (170 kilometers) northwest of Anchorage, Alaska, U.S.A. The Whistler Project consists of several gold-copper porphyry deposits and exploration targets within a large regional land package entirely on State of Alaska Mining claims totaling approximately 53,700 acres (217.5 square kilometers).

Visit www.usgoldmining.us for more information, including high resolution figures.

For additional information, please contact:

U.S. GoldMining Inc.

Alastair Still, Chair

Tim Smith, Chief Executive Officer

Telephone Toll Free: 1-833-388-9788

Email: info@usgoldmining.us

In Europe

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Forward-Looking Statements

Except for the statements of historical fact contained herein, the information presented in this news release constitutes “forward-looking statements” within the meaning of the United States federal securities laws and “forward-looking information” within the meaning of applicable Canadian securities laws (collectively, "forward-looking statements"). Such statements include statements with regard to the Company’s expectations regarding the Project, the proposed PEA and the policy climate in Alaska and the United States. Words such as "expects", "anticipates", “plans”, estimates” and "intends" or similar expressions are intended to identify forward-looking statements. Forward-looking statements are based on U.S. GoldMining’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict and involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors include, among others, the actual results of future exploration may not confirm expectations, variations in the underlying assumptions associated with the estimation or realization of mineral resources, the availability of capital to fund programs, accidents, labor disputes and other risks of the mining industry including, without limitation, those associated with the environment, delays in obtaining governmental approvals or permits, title disputes other risks inherent in the exploration and development of mineral properties and the other risk factors set forth in the Company’s filings with the U.S. Securities and Exchange Commission at.www.sec.gov and Canadian Securities Administrators at www.sedarplus.ca. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements contained in this news release. Forward-looking statements contained in this news release are made as of this date, and U.S. GoldMining does not undertake any duty to update such information except as required under applicable law.

Notes to Table 1:

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()