Revival Gold delivers compelling PEA results and attractive potential re-development timeline for the Mercur Gold Project

Mercur Heap Leach PEA Highlights[1]

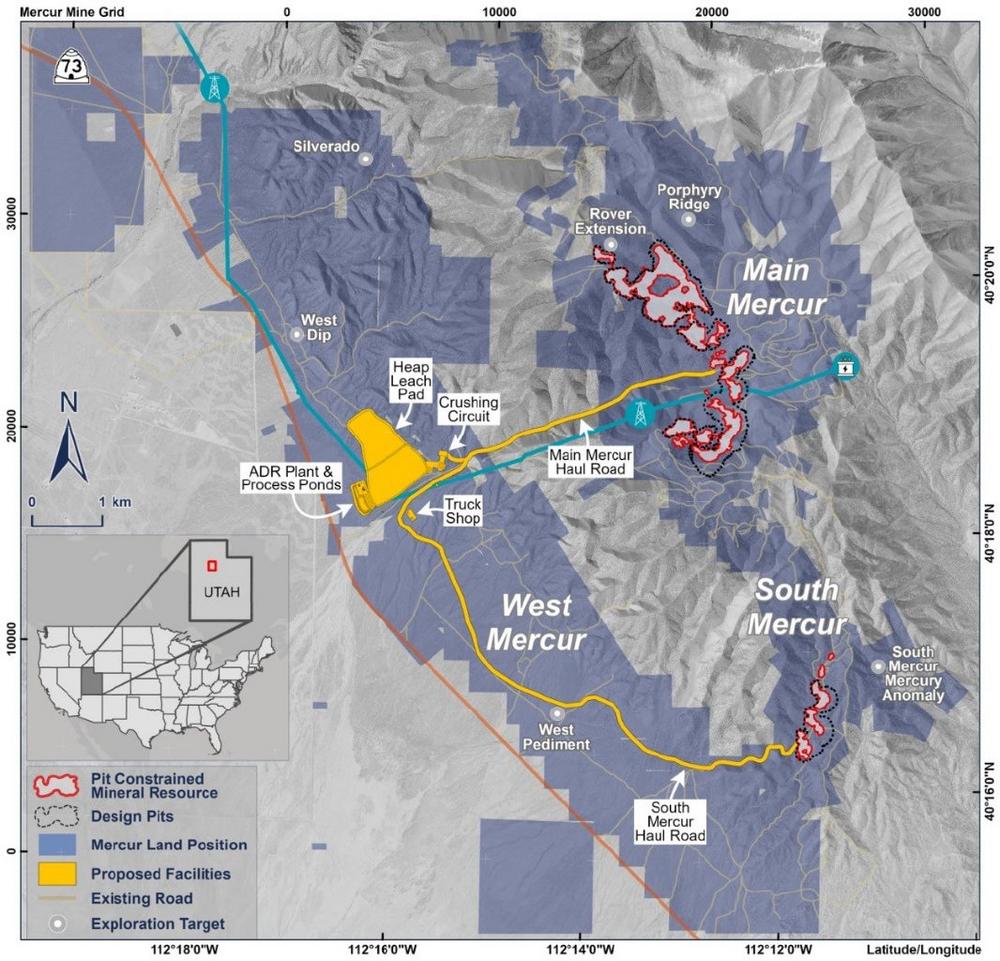

“Completion of this PEA highlights the potential economic value of Mercur and more than doubles Revival Gold’s underlying net asset value from gold”, said Hugh Agro, President & CEO. “Mercur presents a unique opportunity for relatively near-term U.S. gold production from a low-risk, low capital project at a logistically superior domestic mine site. The Project features robust economics including a $294 million after-tax NPV and a compelling 27% after-tax IRR at $2,175 gold increasing to $752 million and 57% at $3,000 gold. Over the course of the next two years, Revival Gold intends to focus on low-risk resource conversion and expansion, additional engineering studies and the completion of Project permitting”, added Agro.

“As a brownfield site, Mercur offers significant historical exploration and operational data, excellent logistics including paved access, water supply system, electrical power line and substation, and close proximity to a large, skilled workforce, with the added benefit of exemplary historical environmental performance that should translate into a shorter permitting schedule and lower technical and execution risk”, noted John Meyer, Vice President, Engineering & Development.

This PEA is preliminary in nature. In addition to Indicated Mineral Resources, it includes Inferred Mineral Resources that are considered too speculative geologically to apply economic considerations that would enable categorization as Mineral Reserves, and there is no certainty that the PEA will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

The PEA was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) guidelines by Kappes, Cassiday & Associates (“KCA”) of Reno, Nevada and RESPEC Company LLC (“RESPEC”) of Reno, Nevada (the “Study Authors”) with an effective date of March 25th, 2025. The Company will file a technical report summarizing the PEA on www.revival-gold.com and on SEDAR+ at www.sedarplus.ca in accordance with NI 43-101 within 45 days.

Further Information is attached.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()