SXG Extends Mineralization 450 m Down Dip at Golden Dyke Drills 3.4 m @ 53.7 g/t Au and 0.4 m @ 291.3 g/t Au at Rising Sun Fifth Rig Added to Project

Breaking News:

Donnerstag, Apr. 24, 2025

Highlights:

· SDDSC121W1 drilled west to east at Rising Sun to extend the strike length of the NW-SE oriented veins sets (“rungs”). It intersected six high-grade vein sets and one previously unmodelled vein set. It included eight assayed intervals of > 10 g/t Au (up to 558.0 g/t Au), and six assayed intervals > 5% Sb (up to 19.9% Sb). Selected highlights include:

– 1.0 m @ 11.7 g/t AuEq (3.1 g/t Au, 4.6% Sb) from 618.6 m, including:

0.7 m @ 15.2 g/t AuEq (2.8 g/t Au, 6.6% Sb) from 618.9 m

– 0.4 m @ 311.3 g/t AuEq (291.3 g/t Au, 10.6% Sb) from 622.6 m (new vein set defined)

– 3.4 m @ 56.0 g/t AuEq (53.7 g/t Au, 1.2% Sb) from 661.1 m, including:

1.9 m @ 98.2 g/t AuEq (94.7 g/t Au, 1.9% Sb) from 661.7 m

· Drillhole SDDSC120 drilled east to west across Rising Sun and beneath Golden Dyke, intersected five mineralised domains and discovered a new mineralised vein set 450 m vertically down dip below previous drilling at Golden Dyke, within a parallel mineralised zone (a new “golden ladder”) in the footwall. Although of moderate grade, this very large step out is considered extremely encouraging as it shows, for the first time the mineral system continuing 450 m below the main historic mines on the project. Selected highlights include:

– 2.7 m @ 6.1 g/t AuEq (4.5 g/t Au, 0.8% Sb) from 600.4 m, including:

– 0.9 m @ 12.9 g/t AuEq (9.6 g/t Au, 1.7% Sb) from 602.1 m

– 0.5 m @ 3.7 g/t AuEq (3.7 g/t Au, 0.0% Sb) from 937.0 m (parallel zone in footwall)

· The fifth drill rig has arrived at site and is drilling at the Christina prospect located 500 m west of Golden Dyke. Eight drill holes on the project are currently being processed and analyzed, with five holes in progress.

· Mawson owns 96,590,910 shares of SXG (49.3%), valuing its stake at A$211.5 million (C$193.7 million) based on SXG’s closing price on July 19, 2024 AEST.

Michael Hudson, Mawson Interim CEO and Executive Chairman, states: “Once again Sunday Creek delivers continued success on multiple fronts.

“Intersecting mineralisation 450 m down dip below Golden Dyke in a parallel structure speaks to the multiple opportunities to extend the volume of mineralisation down dip. Although moderate grade, this very large step shows, for the first time, the mineral system continuing 450 m below the main historic mines on the project. It also leads to further opportunities to multiple “golden ladder” host structures. Further drilling is of course required to demonstrate how the system will develop in these areas, which SXG are already undertaking. Given the success of the system getting better at depth in the adjacent Rising Sun and Apollo areas, we have high expectations.

“It is also encouraging to witness the success of the SDDSC121/121W1 drill pair confidently intersect high-grade mineralisation where predicted. This demonstrates the robustness of our geological model and the ability to increase ounces by targeting high-grade strike extensions of multiple vein sets. Additionally, the ability of the SXG team to monitor drill holes in real time and to make deviations to ensure holes are drilled to plan is also extremely positive.

“Now we have five rigs drilling at site, we look forward to more than doubling the metres drilled at Sunday Creek via the 60 km of drilling planned over the next year.”

Drill Hole Discussion

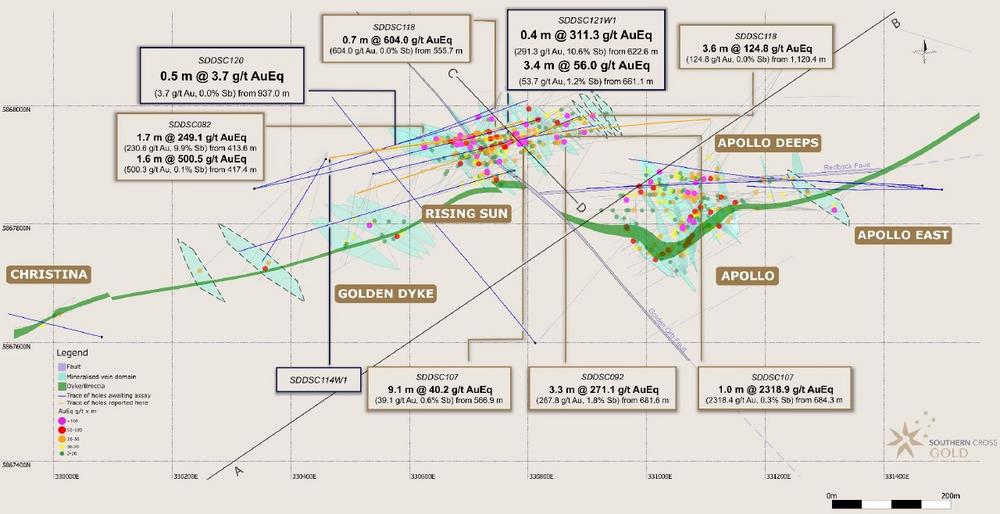

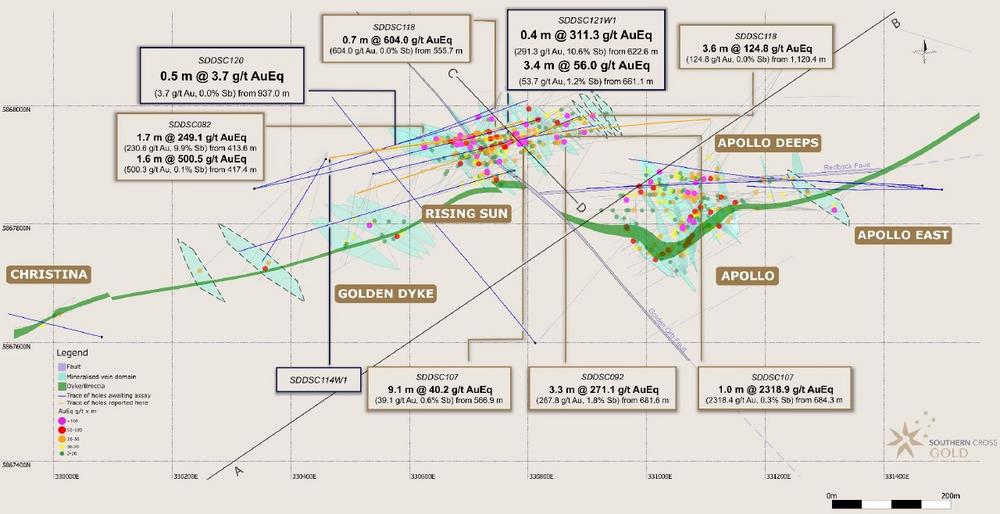

Four drill holes (SDDSC114W1, 120, 121 and 121W1) are reported from the Rising Sun and Golden Dyke prospects (Figure 1 and Figure 2).

SDDSC120 was designed to drill within and parallel to the dyke/breccia host, at a high angle to mineralized vein sets, across Rising Sun and further west to test mineralization deep below Golden Dyke. This hole intersected five known mineralized domains within Rising Sun and one previously undrilled mineralized zone (0.5 m @ 3.7 g/t AuEq from 937.0 m) 450 m below previous drilling (SDDSC062) and 560 m below historic Golden Dyke workings. The footwall discovery was fortuitously tested earlier than planned as the hole exited the main dyke/breccia host sooner than expected.

Highlights from SDDSC120 include:

SDDSC121 was designed to test the footwall position of two mineralized domains and deviated against plan resulting in the need to deflect the hole with daughter hole SDDSC121W1. The daughter wedge commenced at 550 m downhole and successfully intercepted and added strike continuity to seven high-grade vein sets including one previously undefined mineralized domain between RS40 and RS50 (0.4 m @ 311.3 g/t AuEq (291.3 g/t Au, 10.6% Sb) from 622.6 m) by an average of 15 metres. SDDSC121W1 extended the RS50 high-grade core shape down plunge by 30m with 3.4 m @ 56.0 g/t AuEq (53.7 g/t Au, 1.2% Sb) including 1.9 m @ 98.2 g/t AuEq (estimated true width (“ETW”) of 0.8 m) from 661.1 m (Figure 3 and Figure 4). The hole was drilled 68 m and 105 m down plunge respectively from SDDSC050 (7.0 m @ 8.0 g/t AuEq) and SDDSC107 (15.0 m @ 16.3 g/t Au Eq). SDDSC121W1 also contributed two further +100 g/t AuEq x m intercepts (at 2 m @ 1 g/t AuEq cutoff) bringing the cumulative total of +100 g/t AuEq x m intercepts to 43 at Sunday Creek.

Highlights from SDDSC121W1 include:

SDDSC114W1 was drilled to test the hanging wall location of several Rising Sun vein sets, however the hole deviated north away from the mineralized zone and only intercepted periphery/background mineralization of two vein sets (Figure 3).

Pending Results and Update

Eight holes (SDDSC122, 122W1, 123-127, 050W1) are currently being processed and analyzed, with five holes (SDDSC128-131, 050W2) in progress (Figure 1 and Figure 2).

About Sunday Creek

The Sunday Creek epizonal-style gold project is located 60 km north of Melbourne within 19,365 hectares of granted exploration tenements. SXG is also the freehold landholder of 133.29 hectares that form the key portion in and around the main drilled area at the Sunday Creek Project.

Gold and antimony form in a relay of vein sets that cut across a steeply dipping zone of intensely altered rocks (the “host”). When observed from above, the host resembles the side rails of a ladder, where the sub-vertical mineralised vein sets are the rungs that extend from surface to depth. At Apollo and Rising Sun these individual ‘rungs’ have been defined over 350 m depth extent from surface to 550 m below surface, are 10 m to 20 m wide, and 20 m to 100 m in strike.

Cumulatively, 126 drill holes for 55,027 have been reported by SXG (and Mawson Gold Ltd) from Sunday Creek since late 2020. An additional 10 holes for 439 m from Sunday Creek were abandoned due to deviation or hole conditions. Fourteen drillholes for 2,383 m have been reported regionally outside of the main Sunday Creek drill area. A total of 64 historic drill holes for 5,599 m were completed from the late 1960s to 2008. The project now contains a total of forty-three (43) >100 g/t AuEq * m and forty-nine (49) >50 to 100 g/t AuEq * m drill holes by applying a 2 m @ 1 g/t lower cut.

SXG’s systematic drill program is strategically targeting these significant vein formations, initially these have been defined over 1,350 m strike of the host from Christina to Apollo prospects, of which approximately 620 m has been more intensively drill tested (Rising Sun to Apollo). At least 50 ‘rungs’ have been defined to date, defined by high-grade intercepts (20 g/t to >7,330 g/t Au) along with lower grade edges. Ongoing step-out drilling is aiming to uncover the potential extent of this mineralised system.

Geologically, the project is located within the Melbourne Structural Zone in the Lachlan Fold Belt. The regional host to the Sunday Creek mineralisation is an interbedded turbidite sequence of siltstones and minor sandstones metamorphosed to sub-greenschist facies and folded into a set of open north-west trending folds.

Further Information

Further discussion and analysis of the Sunday Creek project by Southern Cross Gold is available on the SXG website at www.southerncrossgold.com.au.

No upper gold grade cut is applied in the averaging and intervals are reported as drill thickness. During future Mineral Resource studies, the requirement for assay top cutting will be assessed.

Figures 1 to 6 show project location, plan and longitudinal views of drill results reported here and Tables 1 to 3 provide collar and assay data. The true thickness of the mineralized intervals reported individually as estimated true widths (“ETW”), otherwise they are interpreted to be approximately 55-65% of the sampled thickness for other reported holes. Lower grades were cut at 1.0 g/t AuEq lower cutoff over a maximum width of 2 m with higher grades cut at 5.0 g/t AuEq lower cutoff over a maximum of 1 m width unless specified.

Technical Background and Qualified Person

The Qualified Person, Michael Hudson, Executive Chairman and a director of Mawson Gold, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed, verified and approved the technical contents of this release.

Analytical samples are transported to the Bendigo facility of On Site Laboratory Services (“On Site”) which operates under both an ISO 9001 and NATA quality systems. Samples were prepared and analyzed for gold using the fire assay technique (PE01S method; 25 gram charge), followed by measuring the gold in solution with flame AAS equipment. Samples for multi-element analysis (BM011 and over-range methods as required) use aqua regia digestion and ICP-MS analysis. The QA/QC program of Southern Cross Gold consists of the systematic insertion of certified standards of known gold content, blanks within interpreted mineralized rock and quarter core duplicates. In addition, On Site inserts blanks and standards into the analytical process.

MAW considers that both gold and antimony that are included in the gold equivalent calculation (“AuEq") have reasonable potential to be recovered at Sunday Creek, given current geochemical understanding, historic production statistics and geologically analogous mining operations. Historically, ore from Sunday Creek was treated onsite or shipped to the Costerfield mine, located 54 km to the northwest of the project, for processing during WW1. The Costerfield mine corridor, now owned by Mandalay Resources Ltd contains two million ounces of equivalent gold (Mandalay Q3 2021 Results), and in 2020 was the sixth highest-grade global underground mine and a top 5 global producer of antimony.

MAW considers that it is appropriate to adopt the same gold equivalent variables as Mandalay Resources Ltd in its Mandalay Technical Report, 2024 dated March 28, 2024. The gold equivalence formula used by Mandalay Resources was calculated using Costerfield’s 2023 production costs, using a gold price of US$1,900 per ounce, an antimony price of US$12,000 per tonne and 2023 total year metal recoveries of 94% for gold and 89% for antimony, and is as follows:

AuEq = Au (g/t) + 1.88 * Sb(%)

Based on the latest Costerfield calculation and given the similar geological styles and historic toll treatment of Sunday Creek mineralization at Costerfield, SXG considers that a 𝐴𝑢𝐸𝑞 = 𝐴𝑢 (𝑔𝑡) + 1.88 × 𝑆𝑏 (%) is appropriate to use for the initial exploration targeting of gold-antimony mineralization at Sunday Creek.

About Mawson Gold Limited (TSXV:MAW, FRANKFURT:MXR, OTCPINK:MWSNF)

Mawson Gold Limited has distinguished itself as a leading Nordic exploration company. Over the last decades, the team behind Mawson has forged a long and successful record of discovering, financing, and advancing mineral projects in the Nordics and Australia. Mawson holds the Skellefteå North gold discovery and a portfolio of historic uranium resources in Sweden. Mawson also holds 49% of Southern Cross Gold Ltd. (ASX:SXG) which owns or controls two high-grade, historic epizonal goldfields in Victoria, Australia, including the exciting Sunday Creek Au-Sb discovery. On June 10, 2024, Mawson announced the entering into a non-binding term sheet with SXG, contemplating the acquisition of SXG by Mawson through an Australian scheme of arrangement transaction.

About Southern Cross Gold Ltd (ASX:SXG)

[email=https://www.southerncrossgold.com.au/]Southern Cross Gold[/email] holds the 100%-owned Sunday Creek project in Victoria and Mt Isa project in Queensland, the Redcastle joint venture in Victoria, Australia, and a strategic 6.7% holding in ASX-listed Nagambie Resources Limited (ASX:NAG) which grants SXG a Right of First Refusal over a 3,300 square kilometer tenement package held by NAG in Victoria.

On behalf of the Board,

"Michael Hudson"

Michael Hudson, Interim CEO and Executive Chairman

Further Information

www.mawsongold.com

1305 – 1090 West Georgia St., Vancouver, BC, V6E 3V7

Mariana Bermudez (Canada), Corporate Secretary

+1 (604) 685 9316 info@mawsongold.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Forward-Looking Statement

This news release contains forward-looking statements or forward-looking information within the meaning of applicable securities laws (collectively, "forward-looking statements"). All statements herein, other than statements of historical fact, are forward-looking statements. Although Mawson believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. Mawson cautions investors that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, Mawson’s expectations regarding its ownership in Southern Cross Gold, capital and other costs varying significantly from estimates, changes in world metal markets, changes in equity markets, the potential impact of epidemics, pandemics or other public health crises on the Company’s business, risks related to negative publicity with respect to the Company or the mining industry in general; exploration potential being conceptual in nature, there being insufficient exploration to define a mineral resource on the Australian-projects owned by SXG, and uncertainty if further exploration will result in the determination of a mineral resource; planned drill programs and results varying from expectations, delays in obtaining results, equipment failure, unexpected geological conditions, local community relations, dealings with non-governmental organizations, delays in operations due to permit grants, environmental and safety risks, and other risks and uncertainties disclosed under the heading "Risk Factors" in Mawson’s most recent Annual Information Form filed on SEDAR+. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Mawson disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()